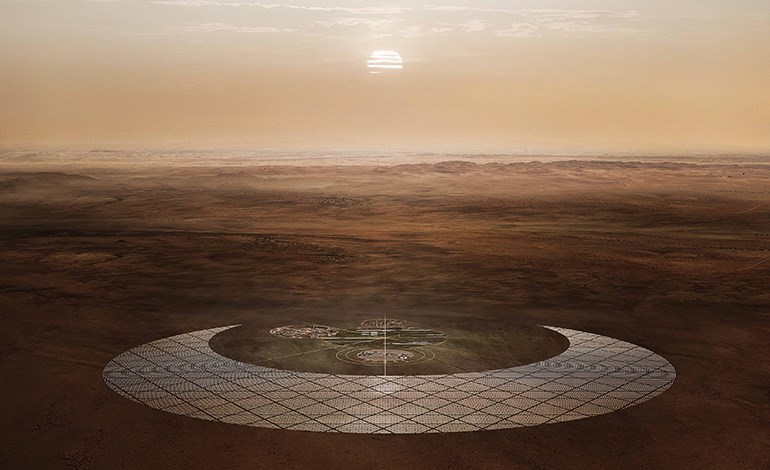

“Revolutionizing the Energy Landscape: DIF Capital Partners Strikes a Transformative Deal with Novar”. In a groundbreaking move, DIF Capital Partners has inked a deal to acquire a 60% stake in Novar, the trailblazing solar and energy storage developer from the Netherlands. This strategic partnership is more than just a business transaction; it’s a step towards a brighter, more sustainable future. With this investment, DIF is not only injecting growth capital but also igniting the expansion of Novar’s impressive portfolio in utility-scale solar, rooftop solar, and cutting-edge battery energy storage systems (BESS). This move is set to enhance Novar’s already formidable presence in the renewable energy sector. Novar, with its headquarters nestled in the vibrant city of Groningen, is no small player in the green energy game.

They boast ownership and operation of a whopping 440MW in utility-scale and rooftop solar, along with BESS projects. But that’s not all – they have an eye-popping development project pipeline exceeding 15GW. Among Novar’s exciting ventures is a pioneering private grid project in the Netherlands. This project isn’t just about connecting several of their large-scale solar and BESS projects; it’s also about launching the nation’s first solar thermal and green hydrogen projects. Novar stands out with its fully integrated independent power producer (IPP) model, showcasing its all-encompassing approach to renewable energy. Gijs Voskuyl from DIF Capital Partners shares his enthusiasm: “Investing in Novar is not just about backing the Dutch solar market leader, it’s about being part of a legacy with a proven track record in both ground-mounted and rooftop projects. With Novar’s existing 440MW portfolio and an extensive pipeline in solar and storage projects, we are thrilled to contribute to the energy transition and look forward to a future of collaborative growth.” Echoing this sentiment, Gerben Smit, CEO of Novar Holding, highlights the strategic partnership’s potential: “This alliance with DIF is a game-changer for Novar. It empowers us to dream bigger, expand our international footprint, and aim for a staggering 4GW of operating capacity by 2030.” The deal, crafted with the expertise of KPMG, McKinsey, Arup, and NautaDutilh for DIF, and Voltiq, Eversheds Sutherland, and Hogan Lovells for Novar, is on the brink of closure, awaiting regulatory nods. Set to finalize in the fourth quarter of 2023, this partnership is not just a business merger; it’s a beacon of hope for a sustainable future.

Credits: [Image: Novar/Jordi Huisman/G2K]